Before proceeding with any financial adjustments and processing for a VAT-registered community, it is essential to implement specific setup changes.

1. VAT setup

1.1. Setup Community as VAT-registered

Navigation: Community Overview > Settings > General

On the landing page, scroll down, tick the box for VAT registered, and enter the VAT number in the field provided, if available.

Note: Navigate to the Global Overview > Communities. VAT-registered communities will be identified by the VAT icon next to the community name.  |

1.2. Setup Ledgers as VAT Applicable

Navigation: Community Overview > Finance > Setup - Financial > General Ledger Tab

On this page, find the ledger account where VAT is applicable, hover over the ledger line item, and click the edit icon.

A pop-up window will appear to edit the ledger item. Click on the Tax Type drop-down and change the type from VAT Not Applicable to the relevant VAT selection, e.g. VAT Normal 15%.

Once the Tax type has been changed, click on the Update Account button at the bottom of the page.

1.3. Enter Budgeted Items with VAT

Navigation: Community Overview > Finance > Setup - Budget

Important: Ensure you are within the correct financial year/ budget period.  |

If the budget is closed, scroll to the bottom, and click Re-Open Budget for Editing.

Locate the VAT budget item and enter the VAT-exclusive amount. Once done, scroll to the bottom of the page and click on Finalize Budget to save any changes.

2. Run Billing

Navigation: Community Overview > Finance > Run Billing

All figures loaded on the Run Billing Screen, whether raised as an additional recovery or billed through PQ/ Ratio, must be VAT-exclusive amounts.

Every amount displayed on the Run Billing Screen, where the ledger account is set up as VAT applicable on the relevant Tax Type, will always display as the Exclusive VAT figure on the Run Billing Screen.

Any other amounts where the ledger account does not have VAT applicable thereon will naturally display the full amount billable to the customer on the Run Billing screen.

To account for the VAT portion for a transaction you raised on the Run Billing screen when you run the billing, the system will automatically raise the VAT on the amounts where the VAT applicable setup was done correctly, and then display the correct full amount payable on the customer invoice and statement.

Important: If Additional Recoveries were loaded before the relevant ledger accounts were amended to be VAT Applicable, then those Additional Recoveries need to be deleted and reloaded, in order for the system to account for the VAT. Herewith is the relevant support article to upload additional recoveries: CMS - Additional Recoveries |

3. Customer Invoicing and Credit Notes

3.1. Create a Manual Customer Invoice

Navigation: Community > Finance > Customer - Invoice

When selecting an item where VAT has been setup, select the relevant Tax Type from the drop-down, and in the same line enter the VAT-exclusive amount.

The system will calculate the Tax and Total. Click Create Invoice when satisfied.

3.2. Create Credit Note

Navigation: Community > Finance > Customer - Credit Note

For VAT Applicable entries, select the customer invoice to be credited. The system will automatically pull the exact data of the invoice for you to pass a credit note on, and this will include the reversal of the VAT portion thereof if applicable.

CMS - How To: Create Credit Note

4. Journal Entries

Navigation: Community Overview > Finance > General - Journals

5. Utility Recovery (Electricity, water and Sewerage)

Navigation: Global Overview > Settings > Utility Schedule

Important: Should the VAT community require the processing of utilities, via the Utilities Schedule (wherein you set up the tariffs), please remember that the tariffs and other charges (as applicable) must be entered as exclusive VAT values. Herewith is the support article for further guidance on the Utility Schedule: |

Note: Ensure the income ledger accounts for utilities (water, sewerage, and electricity recovery) are set up as VAT applicable. |

6. Supplier Invoicing (Including Recurring)

6.1. Create Supplier Invoice

Navigation: Community Overview > Finance > Supplier - Invoice

7. VAT Reporting

When you need to obtain reports on the VAT balances for auditing or submission for payment purposes, the system does provide the required reporting.

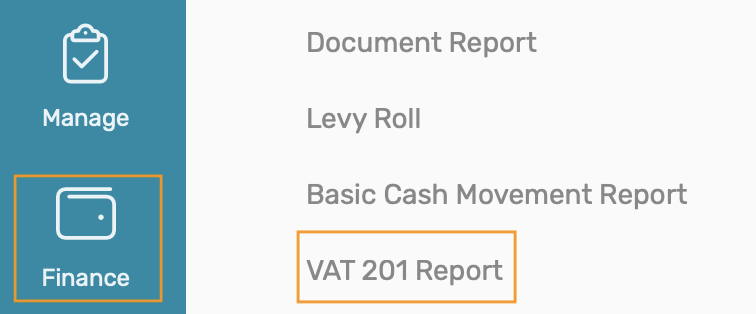

Navigation: Community Overview > Finance > Report - VAT 201 or Detailed General ledger

Detailed General Ledger

This report can be exported in Excel.

VAT 201 Report

The VAT 201 Report offers a detailed breakdown of all costs, regardless of VAT applicability or tax type, based on the selected date for the community. Additionally, this report can be exported to PDF, if a physical copy is needed.

By following these steps, you will ensure that VAT-registered communities are set up correctly and all financial transactions are processed accurately.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article